1. Introduction: Why High-Value Instant Loans Matter Today

Financial needs have evolved rapidly. Modern individuals require quick access to funds for emergencies, education abroad, home renovation, wedding expenses, business expansion, or medical situations. Traditional banking systems usually don’t match the urgency of such needs.

That’s why instant digital lending has become a preferred choice. Bajaj Finance has emerged as one of the leaders in this segment by offering high-value personal loans with:

- Minimal documentation

- Online verification

- Quick approval

- Fast disbursal

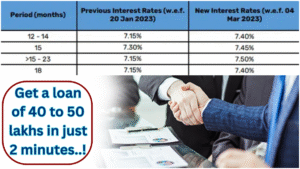

Their promise of a 40 to 50 lakh loan in just 2 minutes is attracting salaried and self-employed individuals across the country.

2. What is Bajaj Finance’s Instant Personal Loan?

Bajaj Finance provides unsecured personal loans, meaning borrowers do not need to pledge any collateral such as property or assets. These loans are processed digitally, and the approval is based on:

- Credit score

- Income stability

- Banking history

- Age

- City tier

- Employer category

The biggest attraction is their fully digital loan application, enabling customers to apply from home using just basic documents and get approval almost instantly.

3. Key Features of Bajaj Finance 40–50 Lakh Loan

Here are the major features that make this loan unique and preferable:

A. Instant Approval in 2 Minutes

The advanced AI-driven verification system checks your eligibility within 120 seconds. Good credit history means faster approval.

B. High Loan Amount (Up to ₹50 Lakh)

Users with stable income and good financial profile can get up to ₹50,00,000 without collateral.

C. Quick Disbursal

Approved loan amount reaches your bank account (sometimes same day).

D. Flexible Tenure

Repayment tenure ranges from 12 months to 96 months, depending on eligibility.

E. 100% Digital Process

Apply through mobile or laptop—no physical documents needed in most cases.

F. Transparent Charges

Interest rates can vary based on profile, but Bajaj Finance is known for transparent terms.

G. Pre-approved Offers

Existing Bajaj Finance customers often get pre-approved loans that require only one click.

H. Freedom to Use Funds

No restrictions on how the loan is used—education, home renovation, travel, emergencies, or business.

4. Why Choose Bajaj Finance for a 40–50 Lakh Loan?

Large personal loans require a trustworthy, financially stable lender. Bajaj Finance offers:

✔ Fastest processing in India

✔ Secure digital ecosystem

✔ No collateral requirement

✔ Loan against minimal documents

✔ Trusted by millions

✔ Approved by RBI norms for NBFCs

Borrowers prefer Bajaj Finance because the company maintains a strong reputation for quick, reliable, and transparent lending.

5. Eligibility Criteria for 40–50 Lakh Loan

To get high-value approval, applicants must meet certain basic criteria:

For Salaried Individuals

- Age: 21–60 years

- Employment: Private sector, public sector, or MNC

- Monthly Income: Typically ₹30,000 to ₹50,000 minimum (varies by city)

- CIBIL Score: 720 or above preferred

- Stable Banking History

For Self-Employed Individuals

- Age: 24–65 years

- Business Vintage: Minimum 2–3 years

- Minimum ITR: Typically ₹3 to ₹5 lakh per year

- Good Credit Score

Higher income and higher credit scores increase chances for a 50 lakh amount.

6. Documents Required for Bajaj Finance Personal Loan

One of the primary reasons the loan is fast is because it requires very few documents:

Mandatory Documents

- Aadhaar Card

- PAN Card

- Latest Salary Slip or Income Proof

- Bank Statements (last 3–6 months)

- Photograph (optional in digital KYC)

- Residential Proof (if needed)

Customers with pre-approved offers generally need only PAN + Aadhaar.

7. Step-by-Step Process: How to Get a Bajaj Finance 40–50 Lakh Loan in 2 Minutes

Follow this simple process for fast approval:

Step 1: Visit Bajaj Finance Website or App

Go to the official Personal Loan section.

Step 2: Check Instant Eligibility

Enter:

- Name

- Mobile number

- PAN

- Date of birth

Within seconds, the system checks your eligibility.

Step 3: Choose Loan Amount (Up to ₹50 Lakh)

Select your preferred loan value:

- ₹40,00,000

- ₹45,00,000

- ₹50,00,000

Step 4: Select Tenure

Choose a comfortable repayment period between 12–96 months.

Step 5: Upload Documents

Upload:

- KYC

- Income proof

- Bank statement

(Some users may not need all documents.)

Step 6: Get Instant Approval in 2 Minutes

AI verifies your profile and gives a decision instantly.

Step 7: Loan Amount Disbursed

Once approved, the loan is transferred to your bank account—sometimes the same day.

8. Interest Rates for Bajaj Finance 40–50 Lakh Loan

Interest rates are calculated based on:

- Credit score

- Income

- Loan tenure

- Loan amount

- Employer profile

Typically, interest ranges from 12% to 20% per year (subject to applicant profile).

High CIBIL Score = Lower Interest.

9. EMI Calculation Example

Here’s an approximate breakdown:

For a 50 Lakh Loan at 12% interest for 7 years

- EMI approx: ₹88,500–₹92,000

- Total repayment approx: ₹74–77 lakh

Using longer tenure reduces EMI but increases total interest.

10. Benefits of Taking a 40–50 Lakh Loan

Large loans often help individuals achieve important financial goals without stress. Benefits include:

A. No Collateral Needed

Borrow ₹50 lakh without mortgaging property.

B. Multi-Purpose Usage

Funding for:

- Medical emergencies

- Education abroad

- Wedding expenses

- Business investment

- Home improvement

- Travel

C. Easy Online Tracking

Monitor EMI dates, outstanding balance, and download statements anytime.

D. Zero Hidden Fees

Transparent terms ensure no surprise charges.

11. Reasons Why Your Loan Can Get Rejected

Sometimes loans get rejected due to:

❌ CIBIL score below 680

❌ Unstable income or job

❌ High existing debts

❌ Mismatch in documents

❌ Frequent EMI bounce history

❌ Low banking balance

Before applying, check your credit report and repay overdue EMIs.

12. Tips to Increase Chances of Getting 40–50 Lakh Approval

To improve your chances:

✔ Maintain CIBIL score above 720

✔ Keep salary in same bank for 3+ months

✔ Avoid late credit card payments

✔ Keep your debt-to-income ratio below 40%

✔ Apply for a loan amount within your limit

✔ Provide accurate documents

A financially disciplined profile improves approval chances significantly.

13. Who Should Consider a 40–50 Lakh loan?

This type of loan is ideal for:

- Salaried professionals with high income

- Self-employed individuals with strong ITR

- Business owners needing expansion funding

- People planning international education

- Families preparing for a large wedding

- Individuals needing emergency funds

The 2-minute approval process ensures you get money without delays.

14. Common Myths About Instant Personal Loans

Myth 1: Approval in 2 Minutes Means Guaranteed Loan

No. The 2-minute window is for preliminary eligibility.

Myth 2: Instant Loans Have Hidden Charges

Not true if you choose reputed lenders like Bajaj Finance.

Myth 3: High loans require collateral

Bajaj Finance personal loans are 100% unsecured.

15. Pros and Cons of Taking a High-Value Loan

Pros

- Fast approval

- No collateral

- Flexible usage

- Easy digital process

Cons

- Higher EMI burden

- Strict credit requirements

- Possible rejection for unstable income

Always borrow according to your repayment capacity.

16. Important Things to Consider Before Applying

✔ Check repayment capability

✔ Compare interest rates

✔ Ensure stable monthly income

✔ Maintain a high credit score

✔ Avoid multiple loan applications at once

These tips protect your financial health in the long run.

17. Conclusion

Bajaj Finance has simplified borrowing by introducing an instant 2-minute approval system that allows eligible applicants to obtain 40 to 50 lakh personal loans quickly and without complications. With a 100% digital process, minimal documentation, and flexible repayment options, this loan is ideal for individuals who need large sums urgently and do not want to go through lengthy traditional bank procedures.

Whether you need funds for personal, medical, educational, or business reasons, Bajaj Finance offers a secure, fast, and transparent borrowing experience. However, ensure you borrow responsibly, maintain a good credit score, and choose an EMI plan that suits your financial capacity.