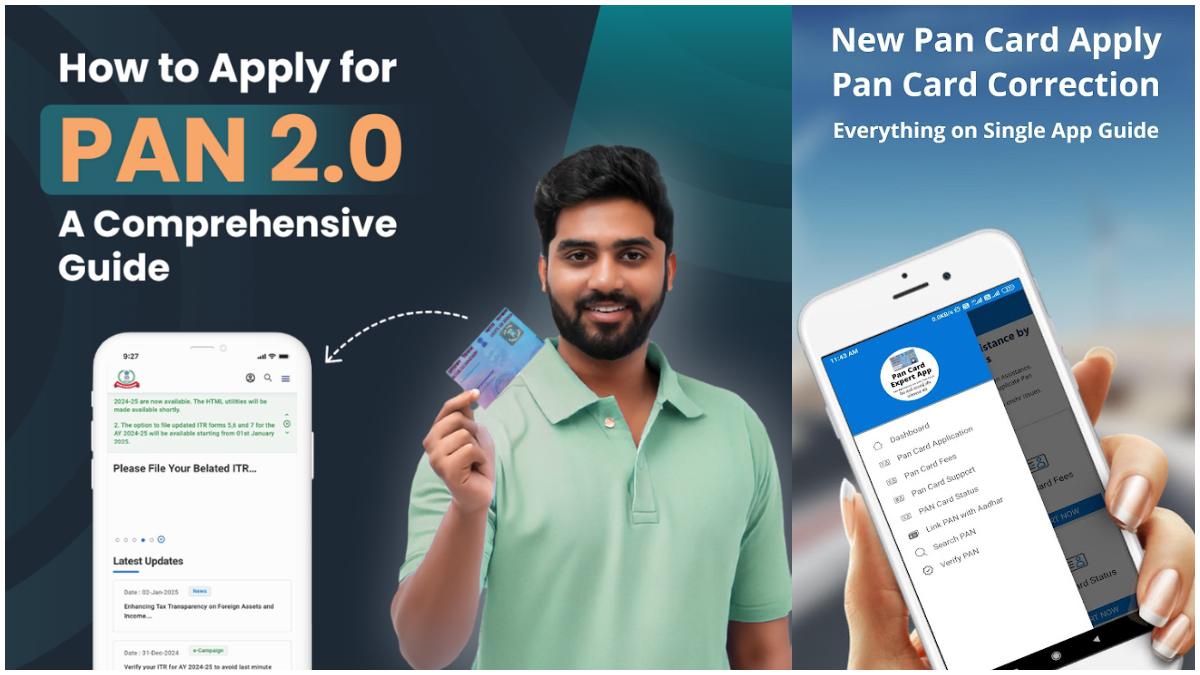

In the era of digital governance, India has taken huge steps to make citizen services easier, faster, and more accessible. One such vital transformation is the ability to review and update your PAN card details using your mobile phone.

The Permanent Account Number (PAN) is not just a tax identification number—it’s a crucial identity document used for banking, investments, government benefits, and many financial transactions. Therefore, keeping your PAN details accurate and up to date is absolutely essential.

If you’ve recently changed your name, shifted homes, got married, or noticed a spelling error in your PAN card, you no longer need to visit a physical office. With just your smartphone, you can review, correct, and update your PAN details online.

This comprehensive guide will walk you through everything you need to know — from why updating PAN data matters, how to do it from your mobile, which documents to prepare, and what mistakes to avoid — all explained in simple terms.

1. Understanding the PAN Card and Its Importance

The Permanent Account Number (PAN) is a ten-character alphanumeric code issued by the Income Tax Department of India. It’s used to track all financial transactions that might attract tax.

PAN serves as a unique identifier for individuals and entities like companies, partnerships, and trusts. Here’s why it matters so much:

- Tax Filings: PAN is mandatory for filing income tax returns.

- Banking & Investments: Needed for opening bank accounts, mutual funds, and share trading.

- Property Transactions: Required for buying or selling property above ₹10 lakh.

- Government Subsidies: PAN helps verify identity for subsidy benefits and pensions.

- Loan Approvals: PAN is crucial for credit score checks and loan processing.

Because it links your financial footprint across various sectors, any error or outdated information in your PAN record can lead to mismatches, rejections, or penalties.

2. Why Review Your PAN Card Regularly?

Many people assume that once their PAN card is issued, it never needs checking again. That’s not true. Regular review helps ensure that your PAN data remains valid and consistent across systems.

Here’s why reviewing your PAN card every few years is beneficial:

- To Avoid Data Mismatch

PAN data must exactly match Aadhaar and other official records. Even small spelling errors can cause your PAN-Aadhaar linking to fail. - To Ensure Financial Compliance

If your details are inaccurate, income tax filings may get rejected, or refunds could be delayed. - To Reflect Major Life Changes

Changes like marriage, legal name change, or address shift must be reflected on your PAN. - To Prevent Identity Fraud

Regularly checking your PAN card helps ensure no one else is misusing your PAN number for fraudulent purposes. - To Simplify Digital Transactions

Banks, stock brokers, and fintech platforms verify PAN instantly. Keeping it updated ensures smooth onboarding and compliance.

3. Key Details to Check on Your PAN Card

When reviewing your PAN details, pay attention to the following fields:

- Full Name – Must be correctly spelled and match Aadhaar/passport.

- Father’s Name – Ensure there are no typographical errors.

- Date of Birth (DOB) – Should match your government-issued IDs.

- PAN Number – The 10-character code should be clearly printed.

- Category/Type – Individual, company, firm, etc., should be correct.

- Photograph and Signature – Should be clear and match your current appearance.

- Communication Address – Important for physical card delivery.

- Aadhaar Linking – Confirm that your PAN and Aadhaar are linked.

If any of these fields contain errors or outdated data, it’s time to update your PAN card.

4. How to Review Your PAN Card via Mobile

You can easily check your PAN details or PAN status directly from your smartphone. Here’s a simple process:

Step 1: Visit the Official Portal

Use your mobile browser and go to either:

- Protean eGov (formerly NSDL) – https://www.protean-tinpan.com

- UTIITSL Portal – https://www.utiitsl.com

Both are authorized by the Income Tax Department to issue and update PAN cards.

Step 2: Choose ‘Know Your PAN’ or ‘PAN Status’ Option

Select “Know Your PAN” or “Track PAN Application Status.”

Step 3: Enter Required Information

You’ll need to input:

- PAN number or Acknowledgement number

- Date of Birth

- Mobile number (linked to Aadhaar)

- Captcha or security code

Step 4: Verify with OTP

An OTP will be sent to your registered mobile number. Enter it to proceed.

Step 5: View PAN Details

After verification, your PAN details—name, DOB, category, and status—will appear.

If everything looks fine, no further action is needed. Otherwise, proceed with correction or update.

5. How to Update or Correct Your PAN Card Using Mobile

You can easily update your PAN information from your smartphone without visiting any center. The process is 100% online.

Step 1: Open the Correction Portal

Go to:

Choose “Changes or Correction in Existing PAN Data.”

Step 2: Select Application Type

Choose “Changes or Correction in existing PAN Data / Reprint of PAN Card.”

Enter category: Individual, HUF, Company, etc.

Step 3: Fill in Personal Details

Provide your existing PAN number, full name, DOB, email, and mobile number. You will get a Token Number or Acknowledgement ID for tracking your application later.

Step 4: Choose What You Want to Update

Tick boxes for the details you want to change (e.g., name, date of birth, address).

Step 5: Upload Supporting Documents

You’ll need to upload digital copies (clear scans or photos) of:

- Proof of Identity (Aadhaar, Passport, Voter ID)

- Proof of Address (Aadhaar, Electricity Bill, Bank Statement)

- Proof of Date of Birth (Birth Certificate, Passport)

- Proof of Name Change (Marriage Certificate, Gazette Notification)

Step 6: Select Mode of Submission

Choose from:

- Paperless Mode (e-KYC and e-Sign) – Fastest, fully online using Aadhaar OTP.

- Physical Mode – Print and send application to the address shown on the portal.

Step 7: Pay Processing Fees

The fees vary slightly depending on the mode and delivery location:

- Within India: ₹101 (for physical card dispatch)

- e-PAN only: ₹66

- Outside India: ₹1,011

You can pay online using credit/debit card, UPI, or net banking.

Step 8: Authenticate with Aadhaar OTP

If you selected paperless mode, you’ll receive an OTP on your Aadhaar-linked mobile. Enter it to complete digital verification.

Step 9: Receive Acknowledgement

After submitting, you’ll get a 15-digit acknowledgement number. Save it to track your application.

Step 10: Download or Receive Updated PAN

- e-PAN can be downloaded within a few hours or days.

- Physical PAN cards are dispatched within 15–30 business days.

6. Common Scenarios for PAN Update

Here are frequent reasons people need to update their PAN details:

a) Name Change After Marriage or Divorce

Upload marriage certificate or gazette notification as proof.

b) Date of Birth Correction

Provide valid DOB proof like a birth certificate, Aadhaar, or school certificate.

c) Change in Father’s or Spouse’s Name

Submit appropriate documents like marriage certificate or legal affidavit.

d) Change of Address or Contact Details

Though PAN doesn’t display your address, updating ensures accurate communication.

e) Photo or Signature Update

If your PAN photo is unclear or outdated, upload a new one and request reissue.

f) Reissue of Lost or Damaged PAN

Select “Reprint PAN” without data changes. The new card will be delivered to your address.

7. Required Documents for PAN Update

| Type of Update | Acceptable Documents |

|---|---|

| Proof of Identity | Aadhaar, Passport, Voter ID, Driving License |

| Proof of Address | Aadhaar, Utility Bill, Rent Agreement, Bank Statement |

| Proof of DOB | Birth Certificate, Passport, Matriculation Certificate |

| Name Change | Marriage Certificate, Gazette Notification, Divorce Decree |

| Foreign/NRI Applicants | Copy of Passport, OCI Card, or Foreign ID Proof |

Make sure all uploaded files are clear and under the size limit (usually under 300 KB for images and 1 MB for PDFs).

8. Fees and Timelines

| Mode | Fee (Approx.) | Processing Time |

|---|---|---|

| e-PAN (digital only) | ₹66 | 1–3 days |

| Physical PAN Dispatch (India) | ₹101 | 15–30 days |

| Physical Dispatch (Overseas) | ₹1,011 | 30–45 days |

Processing time depends on verification speed and document clarity.

9. Safety Tips and Best Practices for Mobile Users

- ✅ Use official websites only: Never click on links received through email or WhatsApp.

- ✅ Avoid public Wi-Fi: Use a secure internet connection when entering personal details.

- ✅ Keep documents ready: Ensure all scans are clear and readable before uploading.

- ✅ Use your Aadhaar-linked mobile for OTP-based verification.

- ✅ Never share OTPs with anyone posing as a “PAN agent.”

- ✅ Save your acknowledgement number for tracking.

- ✅ Track status regularly until your card is delivered.

- ✅ Inform banks and employers after updating details to prevent KYC issues.

10. Common Mistakes to Avoid

- Incorrect spelling or mismatched data – Must match exactly with Aadhaar.

- Uploading unclear documents – Leads to rejection or delay.

- Not linking PAN with Aadhaar – PAN may become inoperative.

- Using fake or third-party websites – May result in data theft.

- Forgetting to download e-PAN – Always keep a soft copy for future use.

- Choosing wrong category (like HUF instead of Individual) – Leads to processing error.

11. Tracking PAN Card Update Status

You can track your PAN update easily using your mobile:

- Visit https://www.protean-tinpan.com

- Select “Track PAN Status”

- Enter Acknowledgement Number

- View current application stage (Under Verification, Printed, or Dispatched)

You can also track via SMS by sending “NSDLPAN ” to 57575.

12. Scams and Fraud Awareness

With the increase in online PAN services, cybercriminals have started phishing scams offering “PAN upgrade” or “PAN verification offers.”

⚠️ Be careful of:

- Fake SMS or emails claiming to verify or upgrade your PAN.

- Requests for payment through personal UPI IDs.

- Websites without “https” or ending in “.com” that mimic government portals.

The Press Information Bureau (PIB) and the Income Tax Department have warned citizens about such fraudulent websites. Always use official portals only for any PAN-related service.

13. What Happens After the Update

Once your application is submitted:

- You’ll get a confirmation message and acknowledgement number.

- The Income Tax Department verifies your documents.

- If approved, updates reflect in the system within days.

- You can download e-PAN immediately or wait for physical card delivery.

- Remember — your PAN number remains the same, only data gets updated.

After receiving the new card:

- Save both e-PAN (PDF) and physical copies.

- Update your details with banks, employers, mutual fund houses, and demat accounts.

14. When Should You Update Your PAN Card?

You should review or update your PAN details in these situations:

- Marriage or legal name change

- Address or contact number change

- DOB or father’s name correction

- PAN-Aadhaar mismatch

- Lost or damaged PAN card

- Outdated photograph or signature

Keeping your PAN accurate ensures smooth financial operations and avoids issues with banks or the Income Tax Department.

15. Conclusion

Your PAN card is one of the most vital identity and tax documents you possess. Errors or outdated details can cause serious inconvenience—from failed Aadhaar linking to delayed refunds or rejected KYC applications.

Fortunately, updating and reviewing your PAN card has never been easier. Using your smartphone, you can complete the entire process — from reviewing details to uploading documents and paying fees — in just a few minutes.

By following this step-by-step guide, you can ensure your PAN card remains accurate, active, and compliant with government requirements