Introduction

As India steps into 2025, the financial landscape is witnessing increased volatility. Rising inflation, global uncertainties, and fluctuating stock markets have left many investors searching for reliable, safe avenues to secure their hard-earned money. In such a scenario, Post Office Savings Schemes (commonly known as POS Schemes) continue to hold a place of prominence, especially among conservative investors, senior citizens, parents saving for their children’s future, and rural households.

Backed by the Government of India, Post Office Savings Schemes provide a secure, low-risk investment alternative with attractive interest rates, tax benefits, and simple processes for opening and managing accounts. With schemes that cater to a variety of financial goals—whether for retirement planning, child education, or assured monthly income—Post Office Schemes remain highly relevant in 2025.

This guide offers an in-depth look into the top post office savings schemes, highlighting the key features, benefits, eligibility, tax implications, and investment strategies to help investors make informed decisions in today’s economic climate.

Why Post Office Savings Schemes Are Still Vital in 2025

Despite the rise of digital investment platforms, mutual funds, and stock market apps, Post Office Schemes have maintained their significance, particularly for conservative and middle-class investors. The key reasons these schemes continue to be popular include:

1. Government Guarantee

Every post office savings scheme is backed by the Government of India, assuring investors of no risk of default. In uncertain economic conditions, such security becomes paramount for those seeking stability.

2. Regular Interest Rate Reviews

Interest rates are reviewed quarterly, ensuring that they remain in line with prevailing market trends. For the second quarter of FY 2025–26 (July to September), no major changes were announced, reinforcing the consistency that investors value.

3. Pan-India Accessibility

Post Office Schemes are accessible across the entire nation, reaching even the most remote rural locations. This makes them ideal for individuals who do not have easy access to private banks or digital financial services.

4. Tax Benefits

Certain schemes offer attractive tax benefits under Section 80C of the Income Tax Act, while some enjoy the full EEE (Exempt-Exempt-Exempt) status. These incentives make post office investments more lucrative, especially for salaried professionals.

5. Comprehensive Coverage of Financial Needs

Post Office Schemes are designed to meet a wide variety of financial objectives, including retirement planning, child education and marriage, regular monthly income, short- to medium-term savings, and assured capital doubling.

Detailed Analysis of Post Office Savings Schemes in 2025

Let’s explore each major Post Office Scheme in detail, examining the features, eligibility, benefits, and tax implications.

1. Senior Citizens Savings Scheme (SCSS)

- Interest Rate: 8.2% per annum

- Tenure: 5 years, extendable by an additional 3 years

- Eligibility: Indian residents aged 60 and above. Additionally, individuals aged 55 and above who have retired under specific government schemes are eligible.

- Tax Benefit: Contributions qualify for tax deduction under Section 80C (up to ₹1.5 lakh per annum). However, the interest earned is taxable as per the individual’s income slab.

- Ideal For: Retirees seeking a safe investment with stable, regular returns to supplement their pension or savings.

Why Choose SCSS?

SCSS is among the highest-interest-bearing government schemes in 2025, making it highly attractive to senior citizens who prioritize safety and liquidity over high returns. The quarterly interest payouts also offer consistent cash flow.

2. Sukanya Samriddhi Yojana (SSY)

- Interest Rate: 8.2% per annum

- Tenure: Till the girl child turns 21, with deposits allowed up to the first 15 years.

- Eligibility: Parents or guardians of a girl child below the age of 10 years.

- Tax Benefits: EEE (Exempt-Exempt-Exempt)—investments, interest earned, and maturity amounts are completely tax-free.

- Ideal For: Long-term financial goals such as a daughter’s higher education or marriage.

Why Choose SSY?

SSY remains the best government-backed investment for parents prioritizing their daughters’ future. The combination of attractive interest, tax-free returns, and the social initiative supporting girl child education makes it widely popular.

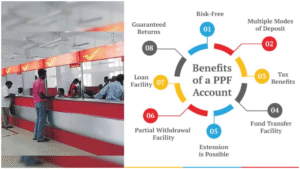

3. Public Provident Fund (PPF)

- Interest Rate: 7.1% per annum

- Tenure: 15 years, extendable in blocks of 5 years

- Eligibility: Any Indian resident can open a PPF account.

- Tax Benefits: EEE status under Section 80C, meaning deposits, interest, and maturity proceeds are exempt from tax.

- Ideal For: Individuals aiming for long-term retirement planning, especially those in salaried employment seeking tax-saving investments.

Why Choose PPF?

PPF is the go-to scheme for systematic, risk-free wealth accumulation over the long term. The 15-year lock-in ensures disciplined savings, and the tax-free growth remains unmatched.

4. National Savings Certificate (NSC)

- Interest Rate: 7.7% per annum

- Tenure: 5 years

- Eligibility: Any Indian resident.

- Tax Benefits: Eligible for Section 80C deduction, although interest earned is taxable but is compounded annually.

- Ideal For: Middle-class investors looking for guaranteed returns over a mid-term horizon.

Why Choose NSC?

NSC offers the assurance of a fixed return, making it suitable for risk-averse investors. With a relatively short tenure and compounded interest, it’s an effective tool for goal-based investing.

5. Post Office Monthly Income Scheme (POMIS)

- Interest Rate: 7.4% per annum

- Tenure: 5 years

- Eligibility: Any resident Indian.

- Tax Benefits: Interest earned is fully taxable; no deduction under Section 80C.

- Ideal For: Retirees and families seeking a reliable monthly income stream.

Why Choose POMIS?

POMIS is favored by retirees or households who need assured monthly payouts. With quarterly interest payouts, it provides a predictable source of income without market-related risks.

6. Post Office Time Deposit (TD)

- Interest Rate: Ranges from 6.9% (1-year deposit) to 7.5% (5-year deposit).

- Tenure: Flexible—1, 2, 3, or 5 years.

- Eligibility: Any Indian resident.

- Tax Benefits: Only the 5-year TD qualifies for Section 80C deduction.

- Ideal For: Investors looking for a short- to medium-term fixed-income option.

Why Choose TD?

Time Deposits provide flexibility with varied tenures to suit different liquidity needs. Investors who prefer short-term parking of funds with a predictable return structure gravitate toward TD.

7. Kisan Vikas Patra (KVP)

- Interest Rate: 7.5% per annum

- Tenure: Fixed period of approximately 115 months (about 9.5 years) for money to double.

- Eligibility: Any resident Indian.

- Tax Benefits: No Section 80C benefit, and the interest is taxable.

- Ideal For: Investors who wish to double their capital with complete assurance over a long tenure.

Why Choose KVP?

The primary appeal of KVP is the guaranteed capital doubling in a fixed timeframe, making it especially attractive for conservative investors who avoid market volatility.

Comparative Snapshot of Post Office Schemes (2025)

| Scheme | Interest Rate | Tenure | Tax Benefit | Ideal For |

|---|---|---|---|---|

| SCSS | 8.2% p.a. | 5 years | 80C | Senior Citizens |

| SSY | 8.2% p.a. | 21 years | EEE | Child Education & Marriage |

| PPF | 7.1% p.a. | 15 years | EEE | Long-Term Retirement Planning |

| NSC | 7.7% p.a. | 5 years | 80C | Middle-Class Safekeepers |

| POMIS | 7.4% p.a. | 5 years | None | Monthly Income |

| TD | 6.9%–7.5% | 1–5 years | 80C (5-year) | Flexible Terms |

| KVP | 7.5% p.a. | 115 Months | None | Guaranteed Doubling |

Who Should Invest in Which Scheme?

➔ Senior Citizens

Ideal combination: SCSS and POMIS. This pairing offers stable monthly income and optimal returns with tax benefits.

➔ Parents Saving for Daughters

SSY is the best fit, delivering the highest returns (8.2%) with full EEE status, making it a tax-efficient vehicle for child’s education or marriage.

➔ Salaried Professionals

PPF offers a robust solution for retirement planning combined with tax savings under Section 80C. It encourages disciplined, long-term savings.

➔ Middle-Class Investors

NSC is a safe, low-risk instrument offering reasonable returns with tax deduction benefits, suitable for mid-term financial goals.

➔ Short-Term Investors

Post Office Time Deposits (TD) offer flexibility in tenure and competitive interest rates, suitable for parking funds for 1 to 3 years.

➔ Conservative Investors

Kisan Vikas Patra (KVP) provides the security of capital doubling in around 9.5 years, without market risks or interest rate fluctuations.

Tax Benefits Explained

- Section 80C Deduction: SCSS, PPF, NSC, Sukanya Samriddhi Yojana, and 5-year Time Deposits qualify under this provision, allowing investors to reduce their taxable income up to ₹1.5 lakh annually.

- EEE Status (Exempt-Exempt-Exempt): Available for PPF and SSY. Contributions, accumulated interest, and maturity proceeds are fully tax-free.

- Taxable Interest: SCSS, POMIS, NSC, and KVP do not enjoy full tax benefits—the interest earned is taxable and must be declared in annual income returns.

Recent Updates (July–September 2025)

In the second quarter of FY 2025–26, the government announced no significant change in interest rates, maintaining stability. The SCSS and SSY continue to offer the highest yield at 8.2%. Additionally, there is a growing push toward digital access, enabling customers to make deposits, track accounts, and withdraw funds more conveniently via digital channels.

Conclusion – Crafting a Balanced Portfolio in 2025

Post Office Savings Schemes continue to be a cornerstone of conservative and stable investing in India. For investors focused on safety, tax efficiency, and predictable returns, these schemes offer unmatched value.

- For retirement goals, combining SCSS and PPF makes for a powerful strategy.

- For children’s future, Sukanya Samriddhi Yojana provides the highest returns in a tax-free structure.

- For monthly income needs, POMIS is the ideal option.

- For mid-term savings, National Savings Certificates and Time Deposits are suitable for assured and steady returns.

- For capital doubling, KVP remains a trustworthy choice.

In a time when the stock market remains volatile and inflation erodes savings, Post Office Schemes are a reliable, simple, and effective solution to preserve and grow wealth